PDF Publication Title:

Text from PDF Page: 004

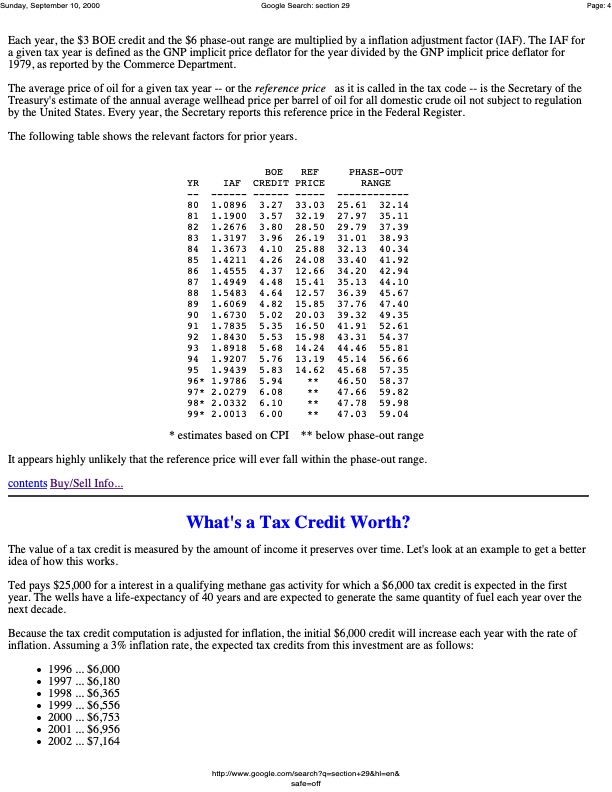

Sunday, September 10, 2000 Google Search: section 29 Page: 4 Each year, the $3 BOE credit and the $6 phase-out range are multiplied by a inflation adjustment factor (IAF). The IAF for a given tax year is defined as the GNP implicit price deflator for the year divided by the GNP implicit price deflator for 1979, as reported by the Commerce Department. The average price of oil for a given tax year -- or the reference price as it is called in the tax code -- is the Secretary of the Treasury's estimate of the annual average wellhead price per barrel of oil for all domestic crude oil not subject to regulation by the United States. Every year, the Secretary reports this reference price in the Federal Register. The following table shows the relevant factors for prior years. BOE REF PHASE-OUT YR IAF CREDIT PRICE RANGE -- ------ ------ ----- ------------ 80 1.0896 3.27 33.03 25.61 32.14 81 1.1900 3.57 32.19 27.97 35.11 82 1.2676 3.80 28.50 29.79 37.39 83 1.3197 3.96 26.19 31.01 38.93 84 1.3673 4.10 25.88 32.13 40.34 85 1.4211 4.26 24.08 33.40 41.92 86 1.4555 4.37 12.66 34.20 42.94 87 1.4949 4.48 15.41 35.13 44.10 88 1.5483 4.64 12.57 36.39 45.67 89 1.6069 4.82 15.85 37.76 47.40 90 1.6730 5.02 20.03 39.32 49.35 91 1.7835 5.35 16.50 41.91 52.61 92 1.8430 5.53 15.98 43.31 54.37 93 1.8918 5.68 14.24 44.46 55.81 94 1.9207 5.76 13.19 45.14 56.66 95 1.9439 5.83 14.62 45.68 57.35 96* 1.9786 5.94 ** 46.50 58.37 97* 2.0279 6.08 ** 47.66 59.82 98* 2.0332 6.10 ** 47.78 59.98 99* 2.0013 6.00 ** 47.03 59.04 * estimates based on CPI ** below phase-out range It appears highly unlikely that the reference price will ever fall within the phase-out range. contents Buy/Sell Info... What's a Tax Credit Worth? The value of a tax credit is measured by the amount of income it preserves over time. Let's look at an example to get a better idea of how this works. Ted pays $25,000 for a interest in a qualifying methane gas activity for which a $6,000 tax credit is expected in the first year. The wells have a life-expectancy of 40 years and are expected to generate the same quantity of fuel each year over the next decade. Because the tax credit computation is adjusted for inflation, the initial $6,000 credit will increase each year with the rate of inflation. Assuming a 3% inflation rate, the expected tax credits from this investment are as follows: 1996 ... $6,000 1997 ... $6,180 1998 ... $6,365 1999 ... $6,556 2000 ... $6,753 2001 ... $6,956 2002 ... $7,164 http://www.google.com/search?q=section+29&hl=en& safe=offPDF Image | Section 29 Tax Credits

PDF Search Title:

Section 29 Tax CreditsOriginal File Name Searched:

section29.pdfDIY PDF Search: Google It | Yahoo | Bing

Capstone Turbine and Microturbine: Capstone microturbines used and new surplus for sale listing More Info

Consulting and Strategy Services: Need help with Capstone Turbine, sizing systems, applications, or renewable energy strategy, we are here to assist More Info

Container Lumber Dry Kiln: Since 1991 developing and innovating dry kilns using standard shipping containers More Info

Supercritical CO2 Lumber Dry Kiln: Compact fast drying in 3 days or less for small amounts of wood and lumber drying More Info

BitCoin Mining: Bitcoin Mining and Cryptocurrency... More Info

Publications: Capstone Turbine publications for microturbine and distributed energy More Info

FileMaker Software for Renewable Energy Developing database software for the renewable energy industry More Info

CO2 Gas to Liquids On-Demand Production Cart Developing a supercritical CO2 to alcohol on-demand production system (via Nafion reverse fuel cell) More Info

Stranded Gas for low cost power Bitcoin Mining Using stranded gas for generators may provide breakthrough low power costs for cryptocurrency miners. More Info

| CONTACT TEL: 608-238-6001 Email: greg@globalmicroturbine.com | RSS | AMP |