PDF Publication Title:

Text from PDF Page: 064

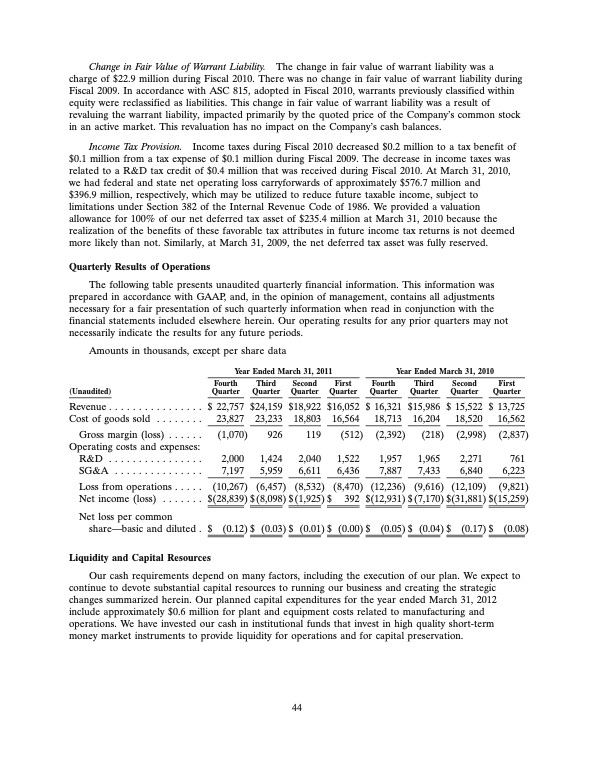

Change in Fair Value of Warrant Liability. The change in fair value of warrant liability was a charge of $22.9 million during Fiscal 2010. There was no change in fair value of warrant liability during Fiscal 2009. In accordance with ASC 815, adopted in Fiscal 2010, warrants previously classified within equity were reclassified as liabilities. This change in fair value of warrant liability was a result of revaluing the warrant liability, impacted primarily by the quoted price of the Company’s common stock in an active market. This revaluation has no impact on the Company’s cash balances. Income Tax Provision. Income taxes during Fiscal 2010 decreased $0.2 million to a tax benefit of $0.1 million from a tax expense of $0.1 million during Fiscal 2009. The decrease in income taxes was related to a R&D tax credit of $0.4 million that was received during Fiscal 2010. At March 31, 2010, we had federal and state net operating loss carryforwards of approximately $576.7 million and $396.9 million, respectively, which may be utilized to reduce future taxable income, subject to limitations under Section 382 of the Internal Revenue Code of 1986. We provided a valuation allowance for 100% of our net deferred tax asset of $235.4 million at March 31, 2010 because the realization of the benefits of these favorable tax attributes in future income tax returns is not deemed more likely than not. Similarly, at March 31, 2009, the net deferred tax asset was fully reserved. Quarterly Results of Operations The following table presents unaudited quarterly financial information. This information was prepared in accordance with GAAP, and, in the opinion of management, contains all adjustments necessary for a fair presentation of such quarterly information when read in conjunction with the financial statements included elsewhere herein. Our operating results for any prior quarters may not necessarily indicate the results for any future periods. Amounts in thousands, except per share data Year Ended March 31, 2011 Year Ended March 31, 2010 Fourth Third Second First Quarter Quarter Quarter Quarter (Unaudited) Revenue................ Cost of goods sold . . . . . . . . Gross margin (loss) . . . . . . Operating costs and expenses: R&D ................ SG&A ............... Loss from operations . . . . . Net income (loss) . . . . . . . Net loss per common share—basic and diluted . Fourth Third Quarter Quarter $22,757 $24,159 23,827 23,233 Second Quarter $18,922 18,803 119 2,040 6,611 First Quarter (1,070) 2,000 7,197 926 1,424 5,959 16,564 (512) 1,522 6,436 18,713 (2,392) 1,957 7,887 16,204 (218) 1,965 7,433 18,520 (2,998) 2,271 6,840 16,562 (2,837) 761 6,223 $16,052 $16,321 $15,986 $15,522 $13,725 (10,267) (6,457) (8,532) (8,470) (12,236) (9,616) (12,109) (9,821) $(28,839) $ (8,098) $ (1,925) $ 392 $(12,931) $ (7,170) $(31,881) $(15,259) $ (0.12) $ (0.03) $ (0.01) $ (0.00) $ (0.05) $ (0.04) $ (0.17) $ (0.08) Liquidity and Capital Resources Our cash requirements depend on many factors, including the execution of our plan. We expect to continue to devote substantial capital resources to running our business and creating the strategic changes summarized herein. Our planned capital expenditures for the year ended March 31, 2012 include approximately $0.6 million for plant and equipment costs related to manufacturing and operations. We have invested our cash in institutional funds that invest in high quality short-term money market instruments to provide liquidity for operations and for capital preservation. 44PDF Image | 2011 Annual Report Capstone Turbine Corporation

PDF Search Title:

2011 Annual Report Capstone Turbine CorporationOriginal File Name Searched:

Capstone-AR2011.pdfDIY PDF Search: Google It | Yahoo | Bing

Capstone Turbine and Microturbine: Capstone microturbines used and new surplus for sale listing More Info

Consulting and Strategy Services: Need help with Capstone Turbine, sizing systems, applications, or renewable energy strategy, we are here to assist More Info

Container Lumber Dry Kiln: Since 1991 developing and innovating dry kilns using standard shipping containers More Info

Supercritical CO2 Lumber Dry Kiln: Compact fast drying in 3 days or less for small amounts of wood and lumber drying More Info

BitCoin Mining: Bitcoin Mining and Cryptocurrency... More Info

Publications: Capstone Turbine publications for microturbine and distributed energy More Info

FileMaker Software for Renewable Energy Developing database software for the renewable energy industry More Info

CO2 Gas to Liquids On-Demand Production Cart Developing a supercritical CO2 to alcohol on-demand production system (via Nafion reverse fuel cell) More Info

Stranded Gas for low cost power Bitcoin Mining Using stranded gas for generators may provide breakthrough low power costs for cryptocurrency miners. More Info

| CONTACT TEL: 608-238-6001 Email: greg@globalmicroturbine.com | RSS | AMP |